do closed end funds have liquidity risk

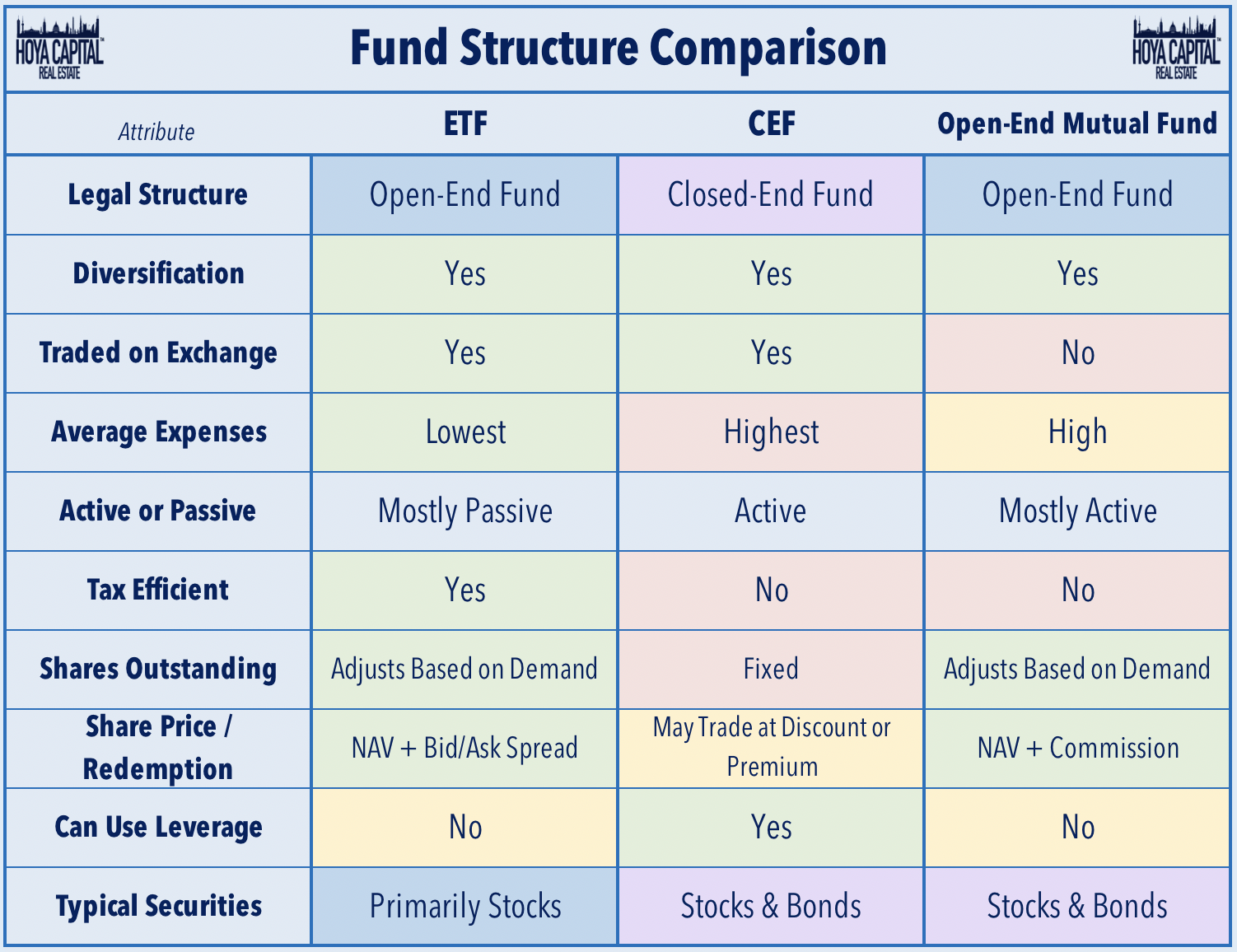

Among the advantages CEFs - unlike open-end mutual funds - trade at a discount or premium to net asset value. Those shares are first issued through an IPO and then trade on an exchange just like stocks or ETFs.

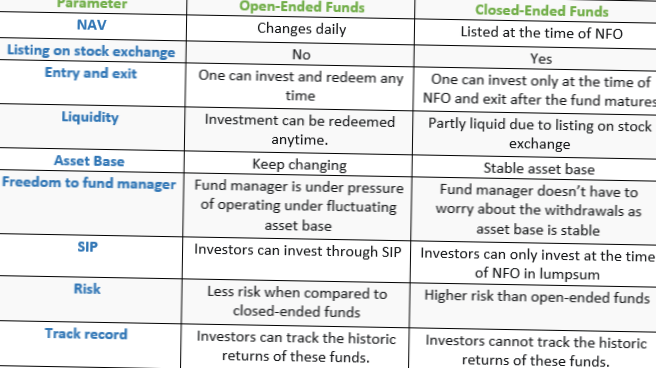

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

Some closed-end funds have a managed distribution strategy.

. Liquidity Risk Although CEFs are listed and traded on an exchange the degree of liquidity or ability to. Therefore there are two potential liquidity effects. Since closed-end funds are a much smaller asset class than open-end mutual funds ETFs and stocks some of them have much less trading liquidity.

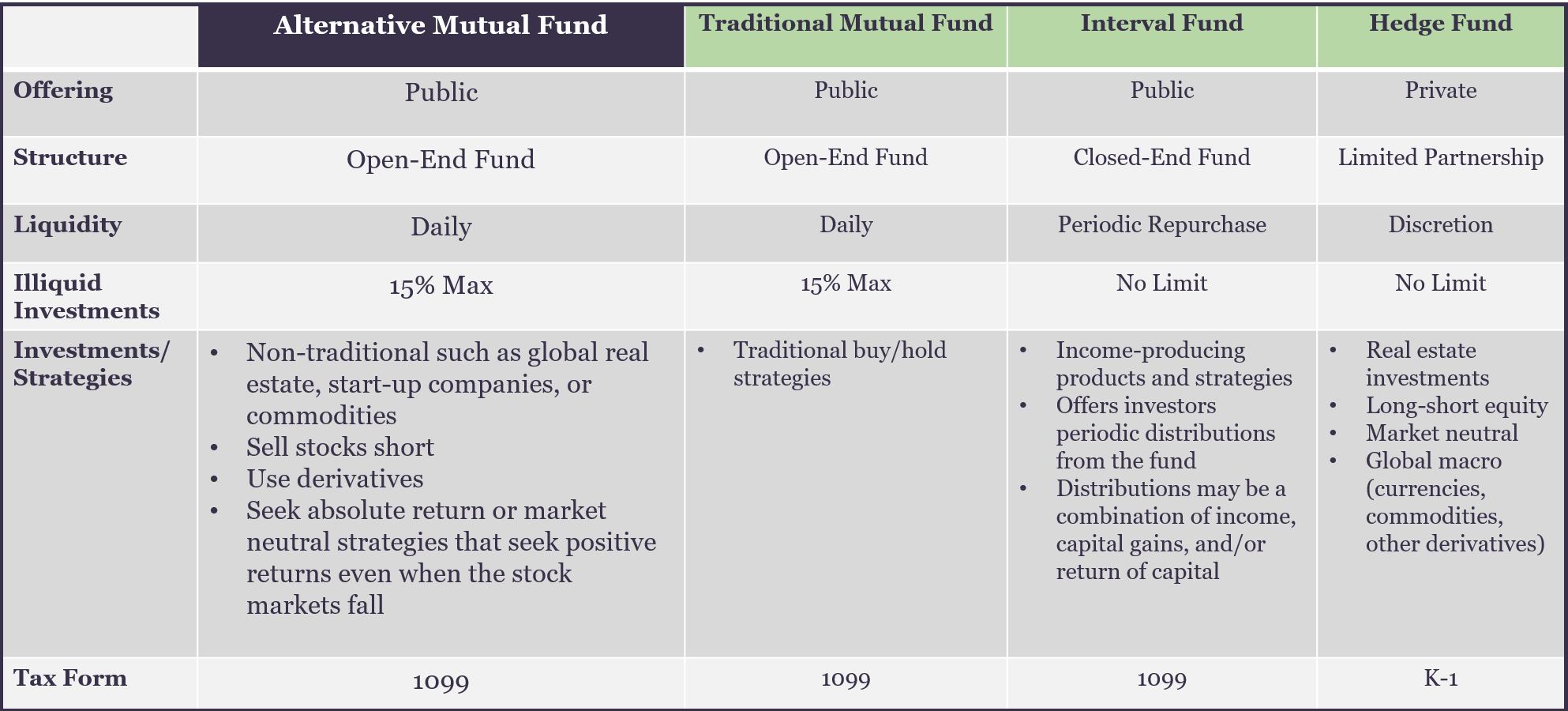

While often compared to traditional open-end mutual funds closed-end funds have many distinguishing features and are perhaps more challenging for potential investors to fully comprehend. Active bond funds more likely to target illiquid investments. Unlike open-end funds managers are not allowed to create new shares to meet demand from investors.

The Investment Company Act of 1940 address two key concerns relating to liquidity risk. Closed-end funds have the ability to use leverage which can lead to greater risk. This provides the benefit of liquidity and the convenience of being able to track an investment with its assigned ticker.

This is a significant risk for closed end bond funds as a default by one or more of the CEFs underlying bond holdings can have a significant impact on the CEFs NAV market price and ability to make distributions to shareholders. This CEF has a leverage ratio of 50 computed as capital from preferred shares divided by net asset value. Get this must-read guide if you are considering investing in mutual funds.

When the Investment Company Act was enacted it was understood that redeemability meant that an open-end fund had to have a liquid portfolio. Closed-end funds CEFs are professionally managed investment companies that offer investors an array of potential benefits. Closed-end funds have more regulatory flexibility than open-end funds to.

Closed-end funds issue a fixed number of shares through an initial public offering and typically do. Unlike open-end funds closed-end funds do not need to maintain liquidity to meet daily redemptions. Funds or funds4 or closed-end upon which several of the Acts other provisions depend.

A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end funds usually mutual funds and unit investments trusts UITs. Closed-end funds with managed distribution programs seek to pay a consistent dividend each month or quarter. Ad Explore Closed End Mutual Funds.

Here are ten reasons to consider closed-end funds. Their yields range from 632 on average for bond CEFs to. See locating the leverage status using the closed-end fund screener for more information.

Just like open-ended funds closed-end funds are subject to market. Closed-end funds CEFs can play an important role in a diversified portfolio as they may offer investors the potential for generating capital growth and income through investment performance and distributions. Funds or funds4 or closed-end upon which several of the Acts other provisions depend turns on whether the investment companys shareholders have the right to redeem their shares on demand.

The value of a CEF can decrease due to movements in the overall financial markets. This makes ETFs much less likely to have. Leverage magnifies returns both positively and negatively.

The use of leverage allows a closed-end fund to raise additional capital which it can use to purchase more assets for its portfolio. Ad Learn why mutual funds may not be tailored to meet your retirement needs. Bond ETFs use of liquidity screens mean they tend to hold less liquidity-risky assets.

LiquidityLow Volume higher liquidity risk exists for funds with low volumes. Closed-end funds CEFs can be one solution with yields averaging 673. Exchange-traded funds ETFs are generally also structured as open-end funds but can be structured as.

On the other hand closed end funds have a fixed number of shares. It also allows funds to only hold a maximum of 15 of fund assets in illiquid securities. A closed-end fund lists on a stock exchange where the shares trade just like stocks throughout the trading day.

Many closed-end funds have income distributions of 8 or more. With a closed-end fund the number of shares is fixed and shares are not redeemable from the fund. In other words it could be harder to buy and sell the stock at desirable prices depending on how many people are willing to take the other side of your trade.

Closed-end funds operate more like ETFs in that they trade throughout the day on a stock exchange. Costs the expense ratios are competitive with most open end mutual funds but still. Changes in interest rate levels can directly impact income generated by a CEF.

Thus they have more flexibility to invest in less liquid securities. The use of leverage allows the CEF to maintain a higher distribution yield than open-end mutual funds. Funds are required to assess manage and periodically review their liquidity risk based on specified factors.

Closed-end funds can offer opportunities but they come with risks Not nearly as popular as open-end mutual funds they provide advantages for long-term investors who can stomach some volatility. Just like open-ended funds closed-end funds are subject to market movements and volatility. The closed-end structure Mark Northway explains provides the manager with the benefit of permanent or long-term committed capital while listing the funds.

It stipulates that mutual funds have up to seven days to distribute sale proceeds to shareholders although most do it the next business day. Open-end mutual funds price their shares only once a. Look for Discounts and Premiums.

So for instance a CEF that is valued at 10 may. Closed-end funds have the ability subject to strict regulatory limits to use leverage as part of their investment strategy. 5 from preferred shares 10 in net asset value 50.

Tourshabana What Are Closed End Vs Open End Mutual Funds Compare 4 Key Differences In Investing

Investing In Closed End Funds Nuveen

Difference Between Open Ended And Closed Ended Mutual Funds Differbetween

What Is The Difference Between Closed And Open Ended Funds Quora

Alternative Mutual Fund Liquidity Spectrum Investment Comparison

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

What Is The Difference Between Closed And Open Ended Funds Quora

Closed End Funds Basics How It Works Pros Cons The Smart Investor

What Are Mutual Funds 365 Financial Analyst

Closed End Fund Definition Examples How It Works

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends