transfer car loan to another person malaysia

Transfer the motor insurance policy. Paycheck stubs from the previous 3 months.

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Initiate registration and insurance transfer only if your bank has consented to the transfer.

. Compare Car Loans in Malaysia 2022. For the purchase of a new car Maybank is offering up to 90 margin of finance with you covering the remaining 10. The inspection and record clearance.

If you want to transfer a car loan to another person you also have to transfer ownership. The deceaseds original death certificate. For an expat to apply for a loan they should make sure they have these documents.

Modify with your existing lender or seek a new lender. In this example you select Maybank Hire Purchase to finance your car purchase. You can transfer the car loan to another person who is looking for a car and an easy deal out of it.

Transferring a Car Loan to Another Person. Thereafter you must request the RTO authorities to transfer the car in the name of new owner. The requirements are similar to those of a loan from an American institution.

All these charges together may make the process of loan transfer an expensive unviable proposition for the buyer. In fact because of this the buyer may insist on splitting the cost of the loan transfer with. There are two primary ways to transfer a car loan to another individual.

The most common criteria include. This will be the last few steps in the whole buying and selling used car process. The benefit will not be accrued or provided to the new owner.

These authorities will then undertake a background verification with your lender before changing the car registration details. The answer to the above is unfortunately No. These costs include processing fee charges by the bank for the loan transfer car registration transfer and car insurance transfer fees.

We recommend just going there early in the morning as they rarely answer phone calls for. Eligibility criteria for car loan balance transfer. The next step is to modify the title of the car to reflect its new owner unless some deal was worked out beforehand where the original loan holder retains ownership.

You should be 60 years or lesser at the end of your loan tenure. Make sure that you have transferred vehicle ownership to the new borrower. Every time someone is added or removed from a car loan the title changes to reflect this.

A few more steps before you can transfer the ownership to your car for now you need to take your car to the nearest PUSPAKOM centre for an inspection. I will elaborate more below separately for easier reference. After the refinance loan is signed by your transfer partner the loan has successfully been transferred to a different name.

Some readers have written to this blog inquiring the transfer of Non Claim Bonus NCB or Non Claim Discount NCD of one vehicle in ones person name to another. Can I transfer my balance bank loan to my sisters name without change in car ownership ie. All one had to do was to sign the MV3 and MV4 forms and obtain the seller and buyer identity cards.

The car would be still on my name. Obviously you will have to get hold of the vehicle registration card too. The eligibility criteria for transferring your auto loan balance may vary from lender to lender.

The process enables the registered owner to change the ownership to the buyer new owner through online transaction provided that both parties use the 1Malaysia ID access 1MID. You should do this to ensure that you dont have to pay insurance premium anymore once the car registration and the loan are transferred to another person. Submit all the related documents updated loan.

Tips For Buying A Second Hand Car In Malaysia. Modifying with your existing lender will present the least penalties to you but it may not be the best deal for the new borrower. You should be at least 21 years old at the time of applying for the loan.

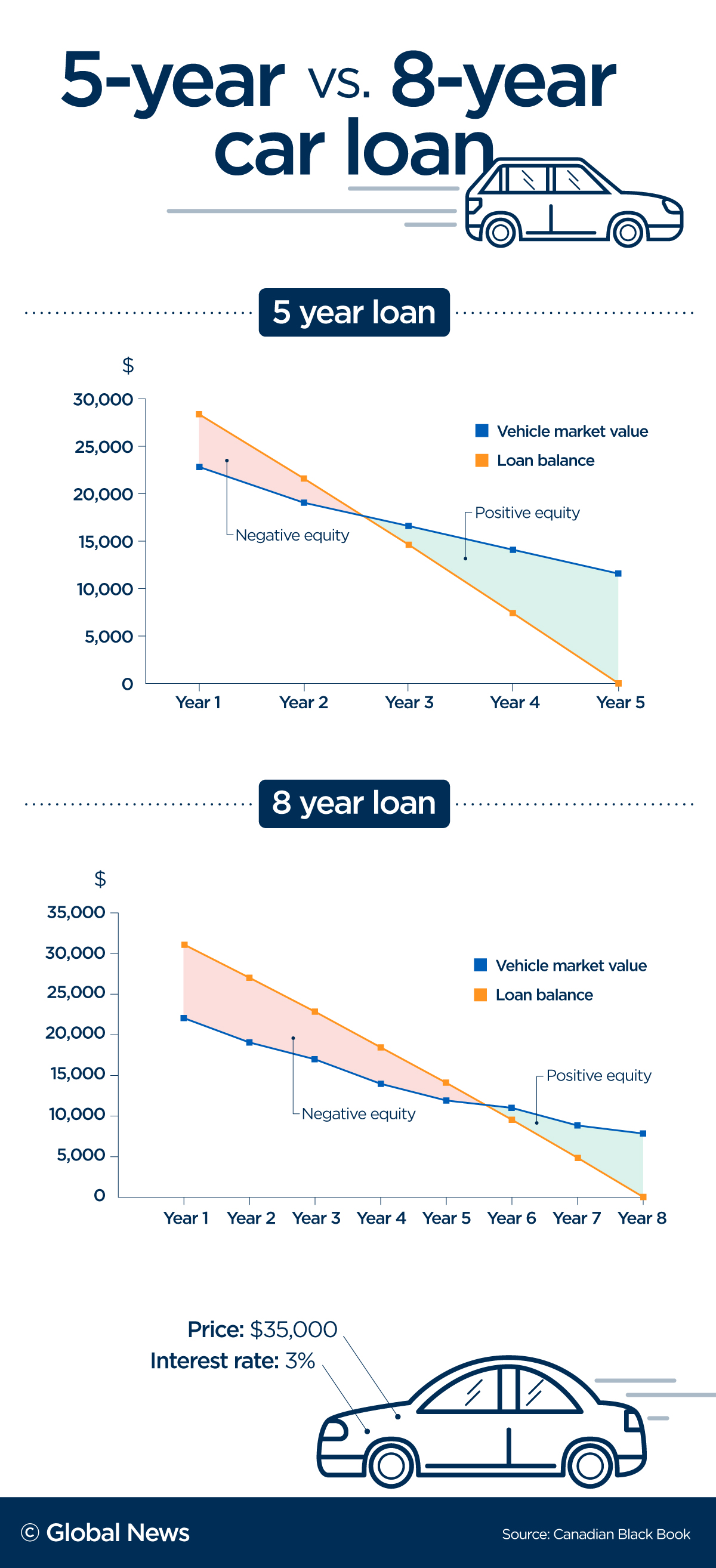

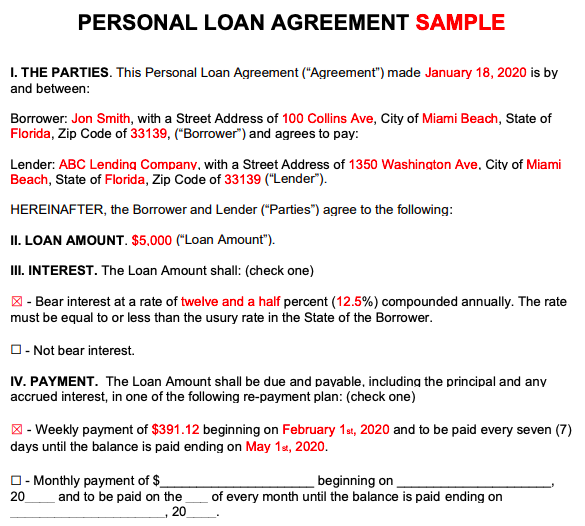

Check with the RTO and insurance provider only after you have got consent from your lender that the transfer is. It is therefore for the insurer only. To illustrate further see the car loan.

I have a purchased i10 2 years ago with loan taken from HDFC bank. With a valid visa and a decent credit rating most expats are able to get loans from a Malaysian bank. After youve done this you seller can start preparing your car for hand over.

Find a suitable buyer or check with car dealerships. Thats just an extra RM50 in balance transfer fees and a whopping RM1058 less than letting the interest charge compound as per our earlier example. By law the person who signed an auto loan is the owner of the car.

Seeking a new lender will end up costing you more but the new borrower will likely see. Prior to opting for a Car Loan transfer make sure you attain consent from your bank. First seek out the approval of your bank to transfer the loan before you venture into the loan transfer process.

Any transfer of ownership requires passing a vehicle inspection by Puspakom the sole vehicle inspection company appointed by the Malaysian government to undertake all mandatory inspections for commercial and public vehicles as well as private vehicles for hire-purchase financing ownership transfer and insurance purposes. The interest rate is priced at 340 annually and you can extend the repayment period for as long as 9 years. First you will have to submit the bank documents showing the details of new borrower to the RTO office.

By using a balance transfer plan to repay his RM5000 debt over 24 months at 0 interest and a one-time fee of 1 Michael only needs to pay RM21042 every month for two years. While you could refinance your car into someone elses name there are easier ways to get rid. Vehicle Ownership Transfer Permanent STMSR is a virtual platform where a vehicle owner can make an ownership transfer without visiting the JPJ Office.

Make sure you identify a buyerborrower with a good credit standing. If you want to transfer a car loan to another person you also have to transfer ownership. You need to ensure that your motor insurance policy is also transferred in the name of the car buyer.

10 15 years ago transfer of car ownership was a simple and easy matter.

Pin On A Vilag Gyonyoru Mecsetjei

If You Are Looking For A Best Advice For Second Mortgage Refinance Loan Then You Must Read T Debt Consolidation Loans No Credit Check Loans Refinance Mortgage

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

Mobile Loans How To Apply For A Loan Via Smartphone Credit Karma

Access American Express To Get Business Gold Rewards Card Benefits American Express Card Balance Transfer Credit Cards American Express

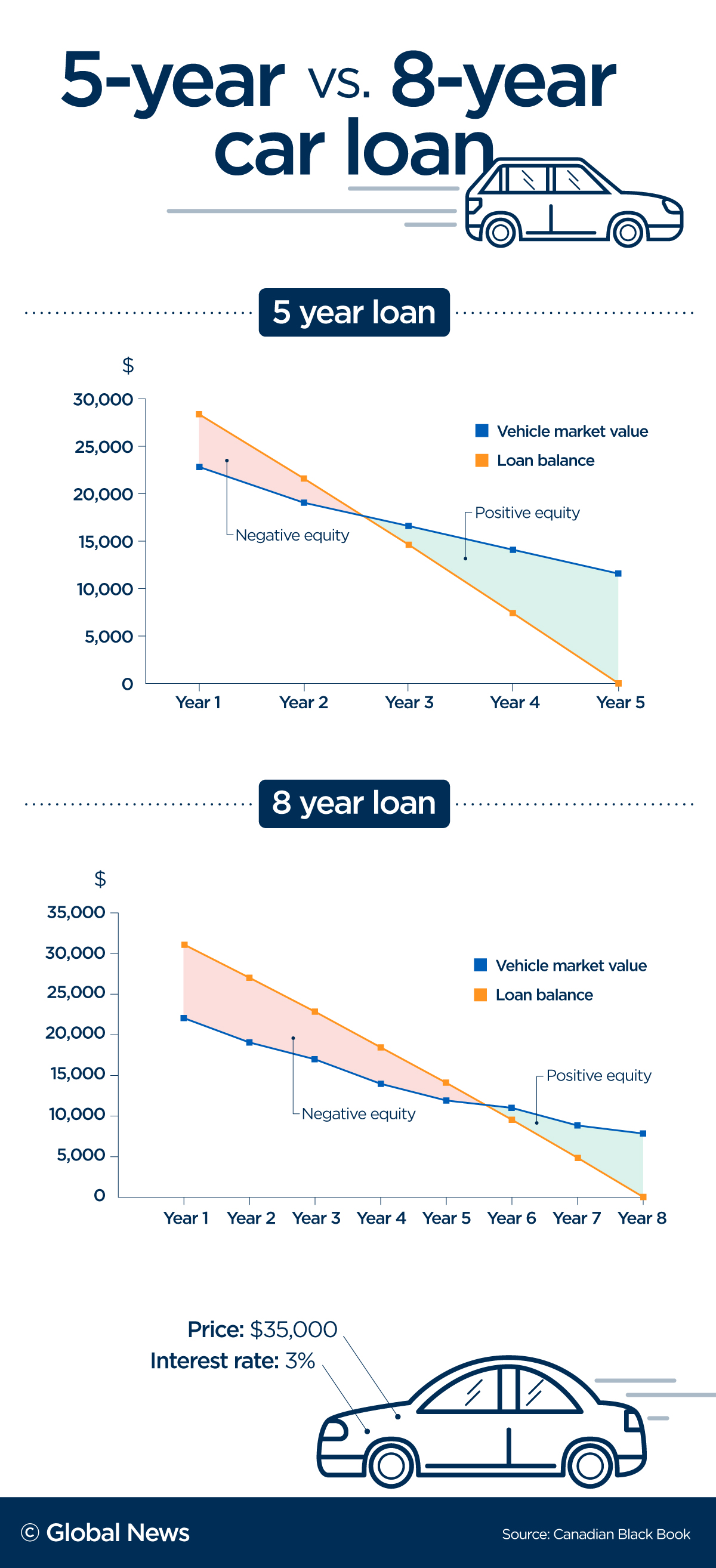

Car Loan Death Clause What You Need To Know Cake Blog

Using A Car As Collateral For A Loan Self Inc

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

How Do I Qualify For A Car Loan Experian

If You Are Looking For A Best Advice For Second Mortgage Refinance Loan Then You Must Read T Debt Consolidation Loans No Credit Check Loans Refinance Mortgage

What Does It Mean To Have A Joint Auto Loan

:strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

For Sale 04 Seremban03 Location Seremban Negeri Sembilan Type Terrace Double Storey Price Rm559888 Size 3284 Sqft Cal Desain Rumah Rumah Rumah Minimalis

Can I Use My Car As Collateral For A Loan

Using A Car As Collateral For A Loan Self Inc

Can I Get A Second Car Loan If I Already Have One Blog Camino Federal Credit Union

Ways To Make Money On A Homestead Champagne And Mudboots Trucos Para Ahorrar Dinero Plan De Pensiones Seguro De Vida

Selling A Car With Outstanding Loan Outstanding Car Loan Cred

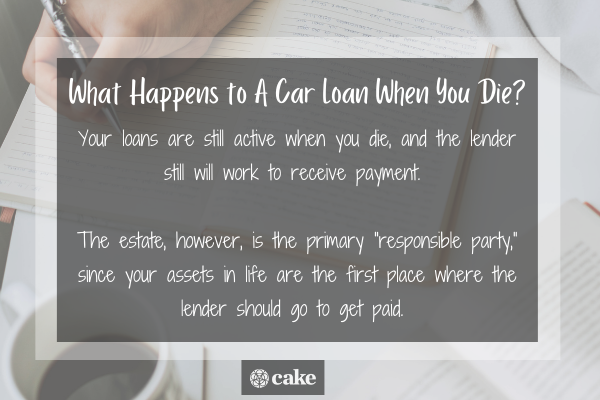

Personal Loan Agreements How To Create This Borrowing Contract